Welcome to our June Newsletter

Australia’s winter housing outlook is improving, with rising property prices and stronger market conditions.

Since February, we have seen three consecutive months of positive growth in housing values due to a significant imbalance between supply and demand.

This month, experts warned that if property prices continued to grow as they have in recent months, we may see a new peak in property prices in 2024.

The direction of housing markets relies on interest rates. Uncertainty remains as economists debate whether we have reached the peak of the rate cycle and when a potential rate cut might occur. Once rates start to decrease, housing markets may gain more momentum.

Interest rate news

At its June meeting, the Reserve Bank of Australia (RBA) increased the cash rate by 25 basis points to 4.10 per cent.

“Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range,” RBA governor Philip Lowe noted in his post-meeting statement.

“This further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe.”

The move means the cash rate is now at an 11-year high.

The average borrower with a $500,000 mortgage before May 2022 could now be paying $1,134 or 49 per cent more a month.

And with warnings, there could be more hikes looming, never has it been so important to review your mortgage. Talk to us and we will compare the market for you.

Home value movements

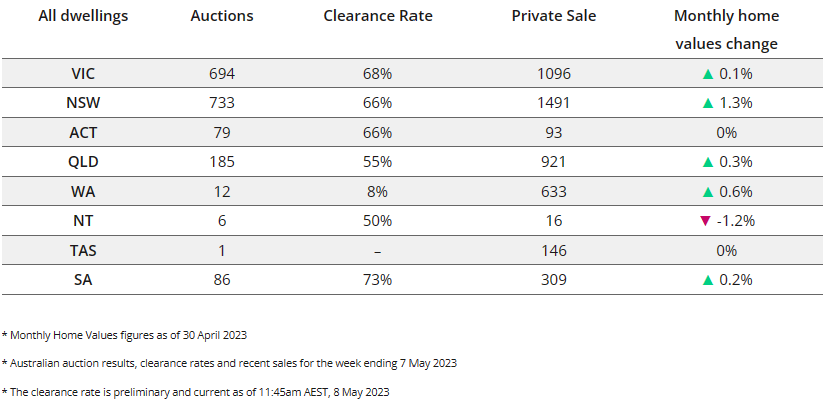

The pace of growth in housing values accelerated sharply to 1.2% in May, according to CoreLogic figures. Not only that – every capital city recorded a positive change in property values in May.

Sydney led the way, with a 1.8% increase in dwelling values over the month. That’s the highest monthly rise for the city since September 2021.

Brisbane (1.4%) and Perth (1.3%) also performed well.

Tim Lawless, CoreLogic’s research director, attributes the positive trend to limited housing supply and growing demand. Increased competition among buyers has led to higher auction clearance rates and faster sales with less negotiation.

“With such a short supply of available housing stock, buyers are becoming more competitive and there’s an element of FOMO creeping into the market. Amid increased competition, auction clearance rates have trended higher, holding at 70% or above over the past three weeks. For private treaty sales, homes are selling faster and with less vendor discounting,” he said.

Regional housing values are increasing, with a 0.5% rise in May. However, the rate of growth in regional areas is not keeping up with major cities, which saw more than triple the growth in the past three months.

In May, the number of homes advertised for sale dropped further. Capital cities, except for Darwin and Canberra, experienced a decline in new listings. Despite this, there was a slight increase in home sales, although they remain below peak levels. The limited housing supply relative to demand is pushing housing values higher, reminiscent of a period of high migration and rising values seen in 2007.

With property prices on the rise, it’s important to have your finance pre-approved, so that you’re ready to jump onto the property of your dreams when you find it.

Talk to us and we will explain which lender has a home loan that would suit your specific financial situation and goals.

Additional sources

CoreLogic RP Data Daily Home Value Index: Monthly Values

https://www.corelogic.com.au/our-data/auction-results

https://www.realestate.com.au/auction-results/